|

QBbgLib

0.4

Qt wrapper for the Bloomberg API

|

|

QBbgLib

0.4

Qt wrapper for the Bloomberg API

|

A response for portfolio information. More...

#include <QBbgPortfolioDataResponse.h>

Public Member Functions | |

| QBbgPortfolioDataResponse () | |

| Creates an empty portfolio response. More... | |

| QBbgPortfolioDataResponse (const QBbgPortfolioDataResponse &other) | |

| Creates a copy of another portfolio response. More... | |

| virtual | ~QBbgPortfolioDataResponse () |

| Destructor. More... | |

| virtual double | cost (int index) const |

| Returns the cost of the nth security in the portfolio. More... | |

| virtual QDate | costDate (int index) const |

| Returns the cost date of the nth security in the portfolio. More... | |

| virtual double | costFx (int index) const |

| Returns the cost FX rate of the nth security in the portfolio. More... | |

| virtual bool | hasCost () const |

| Checks if result contains the cost of the securities in the portfolio. More... | |

| virtual bool | hasCostDate () const |

| Checks if result contains the cost date of the securities in the portfolio. More... | |

| virtual bool | hasCostFx () const |

| Checks if result contains the cost FX rate of the securities in the portfolio. More... | |

| virtual bool | hasMarketValue () const |

| Checks if result contains the market value of the securities in the portfolio. More... | |

| virtual bool | hasPosition () const |

| Checks if result contains the nominal amount of the securities in the portfolio. More... | |

| virtual bool | hasWeight () const |

| Checks if result contains the relative weight of the securities in the portfolio. More... | |

| virtual bool | isEmpty () const |

| Reimplemented from QBbgAbstractResponse::isEmpty() More... | |

| virtual double | marketValue (int index) const |

| Returns the market value of the nth security in the portfolio. More... | |

| virtual QBbgPortfolioDataResponse & | operator= (const QBbgPortfolioDataResponse &other) |

| Copies another portfolio response. More... | |

| virtual double | position (int index) const |

| Returns the nominal amount of the nth security in the portfolio. More... | |

| virtual QBbgSecurity | security (int index) const |

| Returns the nth security in the list. More... | |

| virtual int | size () const |

| Returns the number of securities in the portfolio. More... | |

| virtual double | weight (int index) const |

| Returns the cost relative weight of the nth security in the portfolio. More... | |

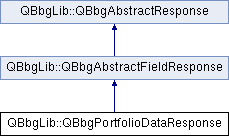

Public Member Functions inherited from QBbgLib::QBbgAbstractFieldResponse Public Member Functions inherited from QBbgLib::QBbgAbstractFieldResponse | |

| virtual | ~QBbgAbstractFieldResponse ()=0 |

| Destructor. More... | |

| virtual const QString & | header () const |

| Header for the response. More... | |

| virtual QBbgAbstractFieldResponse & | operator= (const QBbgAbstractFieldResponse &a) |

| Copies another field response. More... | |

Public Member Functions inherited from QBbgLib::QBbgAbstractResponse Public Member Functions inherited from QBbgLib::QBbgAbstractResponse | |

| virtual | ~QBbgAbstractResponse ()=0 |

| Destructor. More... | |

| virtual BbgErrorCodes | errorCode () const |

| The error code associated with the response. More... | |

| virtual QString | errorMessage () const |

| The details of the error. More... | |

| virtual QString | errorString () const |

| String representation of the error. More... | |

| virtual qint64 | getID () const |

| The ID of the response. More... | |

| virtual bool | hasErrors () const |

| Checks if the response has any error. More... | |

| virtual QBbgAbstractResponse & | operator= (const QBbgAbstractResponse &other) |

| Copies another response. More... | |

| virtual ResponseType | responseType () const |

| Returns the type of the current response. More... | |

Properties | |

| bool | hasCost |

| The result contains the cost of the securities in the portfolio. More... | |

| bool | hasCostDate |

| The result contains the cost date of the securities in the portfolio. More... | |

| bool | hasCostFx |

| The result contains the cost FX rate of the securities in the portfolio. More... | |

| bool | hasMarketValue |

| The result contains the market value of the securities in the portfolio. More... | |

| bool | hasPosition |

| The result contains the nominal amount of the securities in the portfolio. More... | |

| bool | hasWeight |

| The result contains the relative weight of the securities in the portfolio. More... | |

| int | size |

| Number of securities in the portfolio. More... | |

Properties inherited from QBbgLib::QBbgAbstractFieldResponse Properties inherited from QBbgLib::QBbgAbstractFieldResponse | |

| QString | header |

| Header for the response. More... | |

Properties inherited from QBbgLib::QBbgAbstractResponse Properties inherited from QBbgLib::QBbgAbstractResponse | |

| BbgErrorCodes | errorCode |

| The error code associated with the response. More... | |

| QString | errorMessage |

| The details of the error. More... | |

| QString | errorString |

| String representation of the error. More... | |

| bool | hasErrors |

| Checks if the response has any error. More... | |

| bool | isEmpty |

| Check if the response contains any value. More... | |

| qint64 | responseID |

| The ID of the response. More... | |

| ResponseType | responseType |

| Returns the type of the current response. More... | |

A response for portfolio information.

The results will be ordered by currency then by yellow key then by security name. Cash will always appear at the end of the list.

|

virtual |

Destructor.

| QBbgLib::QBbgPortfolioDataResponse::QBbgPortfolioDataResponse | ( | ) |

Creates an empty portfolio response.

| QBbgLib::QBbgPortfolioDataResponse::QBbgPortfolioDataResponse | ( | const QBbgPortfolioDataResponse & | other | ) |

Creates a copy of another portfolio response.

|

virtual |

Returns the cost of the nth security in the portfolio.

If index is out of range or hasCost() is false, 0 returned

|

virtual |

Returns the cost date of the nth security in the portfolio.

If index is out of range or hasCostDate() is false, a null date is returned

|

virtual |

Returns the cost FX rate of the nth security in the portfolio.

If index is out of range or hasCostFx() is false, 0 returned

|

virtual |

Checks if result contains the cost of the securities in the portfolio.

|

virtual |

Checks if result contains the cost date of the securities in the portfolio.

|

virtual |

Checks if result contains the cost FX rate of the securities in the portfolio.

|

virtual |

Checks if result contains the market value of the securities in the portfolio.

|

virtual |

Checks if result contains the nominal amount of the securities in the portfolio.

|

virtual |

Checks if result contains the relative weight of the securities in the portfolio.

|

virtual |

Reimplemented from QBbgAbstractResponse::isEmpty()

Implements QBbgLib::QBbgAbstractResponse.

|

virtual |

Returns the market value of the nth security in the portfolio.

If index is out of range or hasMarketValue() is false, 0 returned

|

virtual |

Copies another portfolio response.

|

virtual |

Returns the nominal amount of the nth security in the portfolio.

If index is out of range or hasPosition() is false, 0 returned

|

virtual |

Returns the nth security in the list.

If index is out of range an invalid security will be returned

|

virtual |

Returns the number of securities in the portfolio.

|

virtual |

Returns the cost relative weight of the nth security in the portfolio.

If index is out of range or hasWeight() is false, 0 returned

|

read |

The result contains the cost of the securities in the portfolio.

|

read |

The result contains the cost date of the securities in the portfolio.

|

read |

The result contains the cost FX rate of the securities in the portfolio.

|

read |

The result contains the market value of the securities in the portfolio.

|

read |

The result contains the nominal amount of the securities in the portfolio.

|

read |

The result contains the relative weight of the securities in the portfolio.

|

read |

Number of securities in the portfolio.

1.8.9.1

1.8.9.1